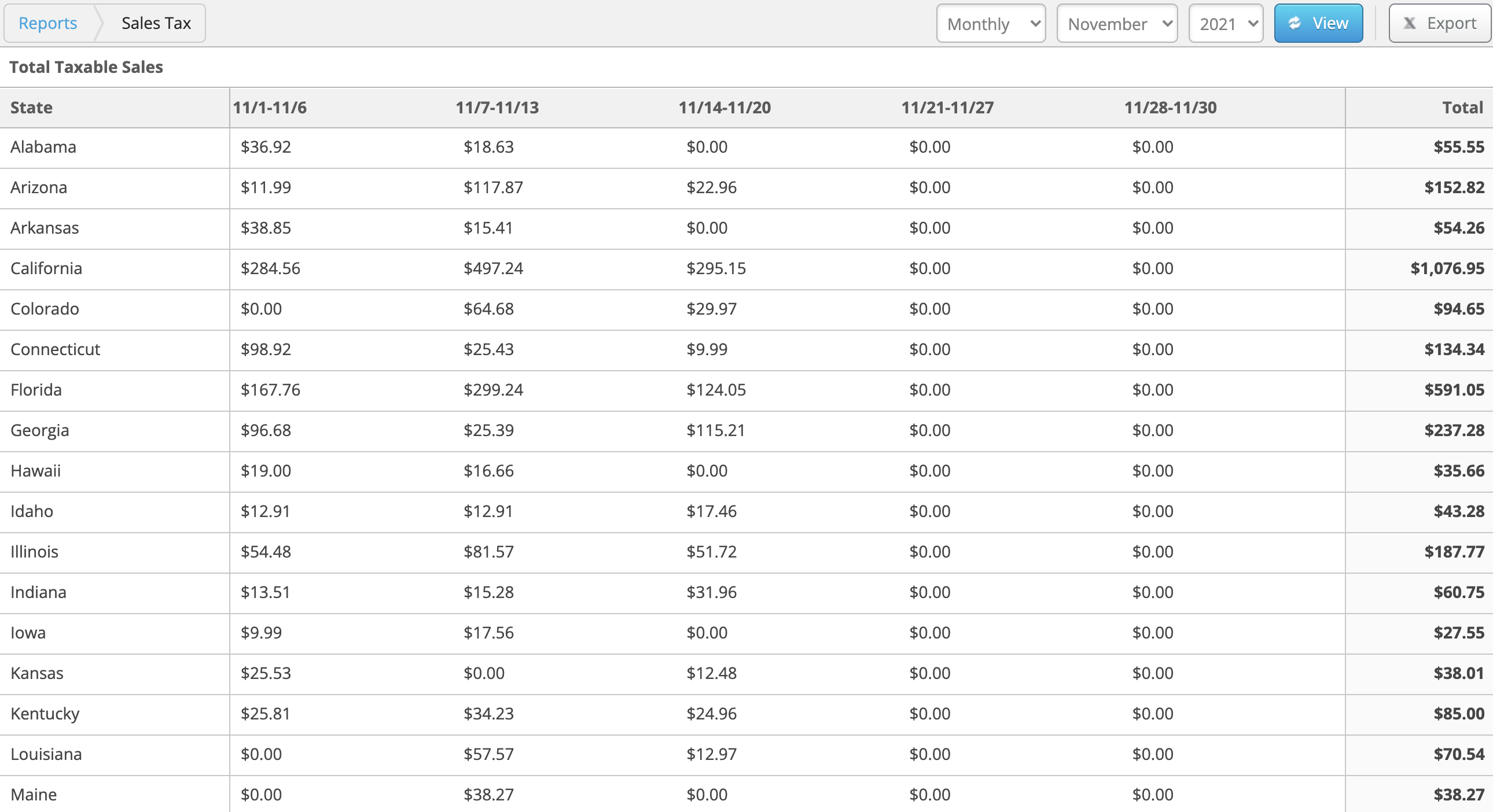

Your Sales Tax Report shows your total taxable sales and sales tax collected for each state you have set up for tax collection in Seller Central. The amounts on this report are synced from Amazon.

If you have questions about the actual process of collecting and remitting sales tax when selling on Amazon, please refer to the following articles from Seller Central:

- Tax policies

- Tax calculation services

- Set up tax calculation services

- US Marketplace Tax Collection FAQ

To view the Sales Tax report in Stratify, click the Reports tab and select Sales Tax from the dropdown menu.

The default view of this report is for the current month. You can change the view to specify a preset date range, based on Daily, Weekly, Monthly, Quarterly, or Yearly.

You can Export any view you select.

This report breaks down the following information:

Total Taxable Sales - The dollar amount of taxable sales

Total Sales Tax Collected - The total sales tax amount collected from your taxable sales

- This will also reflect as Sales Tax Collected in the "Other" area of your Profit & Loss report.

Total Marketplace Facilitator Tax - The amount of sales tax Amazon collected and automatically remitted to the IRS on your behalf

- Currently, Amazon will collect AND remit the sales tax for the states listed in this article from Amazon. This will also reflect as Marketplace Facilitator Tax in the "Other" area of your Profit & Loss report.

Total Sales Tax Refund - The sales tax amount refunded to the buyer due to a return

- This amount is negative since it is refunded to the buyer

Total Marketplace Facilitator Tax Refund - The amount refunded to the seller due to a return

- Since Amazon remitted this amount to the IRS on your behalf previously, they refund this back to your account. This should then be offset by the sales tax refunded back to the buyer.

Hovering over the bar graph at the bottom of the page reveals a quick-glance at the above data points.